The world is all for profit; the world is bustling, all for profit.”

On the one hand, solar energy is inexhaustible.On the other hand, the solar power generation process is environmentally friendly and pollution-free.So, photovoltaic power generation is one of the ideal ways of power generation in the future.

Any form of power generation way to scale or even become the mainstream, will have to be connected to the Internet.

However, power stations will not do a loss business, photovoltaic power generation can not rely on government subsidies to “Internet”, reduce their own costs is the key.

On November 30, Longji shares adjusted the official quotation of monocrystalline silicon wafer, and the price of each size of the silicon wafer fell by 0.41 yuan to ~0.67 yuan / tablet, down from 7.2% to 9.8%.

On December 2, Central shares announced that the silicon wafer price was cut comprehensively,

The price of each size silicon wafer was reduced by 0.52 yuan to 0.72 yuan / piece, or 6.04% to 12.48%.

The price reduction of silicon wafer has triggered a new round of discussion on photovoltaic logic. Flying Whale is here to reorganize the photovoltaic industry chain and related enterprises, and to find out the future direction and logic of photovoltaic for you.

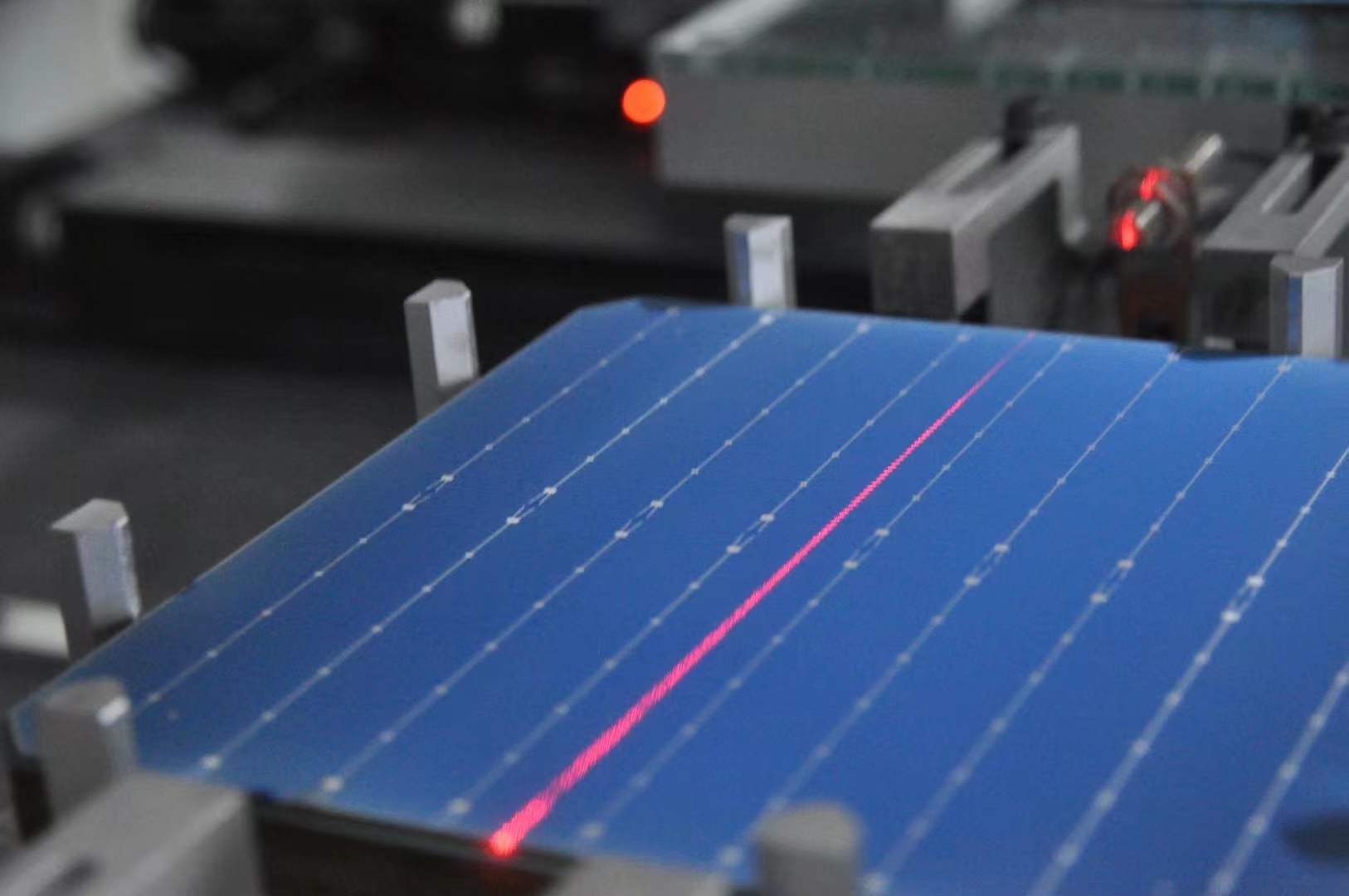

Photovoltaic, that is, photoraw volt.Photovoltaic power generation refers to a new way of power generation to convert solar energy into electric energy. The key element of this technology is solar cells. Solar cells form a large area of solar cell modules, and finally cooperate with the power controller to form photovoltaic power generation devices.

Upstream of the photovoltaic industry chain is the silicon wafer equipment manufacturers.

Crystal silicon, amorphous silicon, GaAs, InP, etc., can be used as solar cell materials.

Crystal silicon photovoltaic power generation is currently the most mainstream way of solar power generation, crystal silicon includes polysilicon and monocrystalline silicon.Monocrystalline silicon battery conversion efficiency and stability, but high cost; polysilicon battery low cost, but poor conversion efficiency.

With the continuous development of monocrystalline silicon technology, the market share of monocrystalline silicon has exceeded 90% in 2020, realizing the further replacement of polysilicon in the silicon wafer market.

The polysilicon industry concentration degree is high, with the leading enterprises including GCL-Poly, Tongwei Yongxiang, Xintai Energy, Xinjiang Daquan and Oriental Hope.The monocrystalline silicon industry presents a double oligarchy competition pattern, and the leading enterprises are Longji Shares and Zhonghuan Shares.

The middle reaches of the photovoltaic industry chain is mainly solar cells and photovoltaic module manufacturers.

Photovoltaic cells are mainly divided into crystalline silicon cells and thin-film cells.Thin-film cells are the second generation of solar cells, with less consumables and low cost, but currently there is still a big gap with the first generation of crystalline silicon solar cells in terms of conversion efficiency.

Crystal silicon cells are the current mainstream photovoltaic cells, and thin-film cells serve as an important supplement to photovoltaic cells.

In 2019, in the global solar cell production composition, crystalline silicon cells accounted for 95.37%, and thin-film cells accounted for 4.63%.

Among the thin film batteries, the conversion efficiency of CIGS thin film battery has improved rapidly in recent years. China’s enterprises involved in CIGS thin film battery include Hanergy, China Building Materials Kaisheng Technology, Shenhua and Jinjiang Group.

Compared with the upstream, the photovoltaic cell market competition pattern is relatively scattered.In 2019, the top five cities in the industry total accounted for 27.4%, among which Tongwei shares had a global market share of 10.1%, making it the world’s largest photovoltaic cell manufacturer.

Photovoltaic module leading has Jinko, JA and Longji shares.In recent years, the market share of photovoltaic modules has accelerated to leading enterprises, and the brand and integration cost advantages are prominent.

From 2011 to 2020, the new photovoltaic installed capacity in China and the world continued to grow. It is expected that the global new photovoltaic installed capacity will reach 300GW in 2025. China’s new photovoltaic installed capacity will account for 35% of the global proportion, with a compound annual growth rate slightly lower than the global average.

Bloomberg (Bloomberg) reported that prices for solar panels have begun to fall this year, while China canceled about 20 megawatts of domestic solar capacity this month.

The result is global overstocking, and prices are now falling faster.

China, the world’s largest solar market, halted new projects with a power capacity equivalent to 20 nuclear power plants.

This is a buyer’s market due to a global oversupply of solar panels, while developers in other countries are delaying purchases, waiting for lower prices.

The average price of polysilicon modules has fallen 4.79% since May 30, falling Wednesday to a record low of 27.8 cents a watt, according to PVInsights.

It would be the biggest monthly decline since December 2016, the last time the industry faced a global oversupply.

China produces 70% of the world’s solar modules.

Post time: Dec-20-2021